Tax Free Savings Account

What is it?

The TFSA was introduced by the Canadian government and came into effect in January 2009 as a way of helping Canadians save for different purposes throughout their lifetime. The TFSA allows for tax-free growth of investment income and capital gains, while providing flexibility for contributions and withdrawals

Contributions

Because of its tax-free aspect, the government imposed maximum contributions inside this account. Moreover, to be allowed to contribute you must be:

- Canadian residents

- aged 18 or older

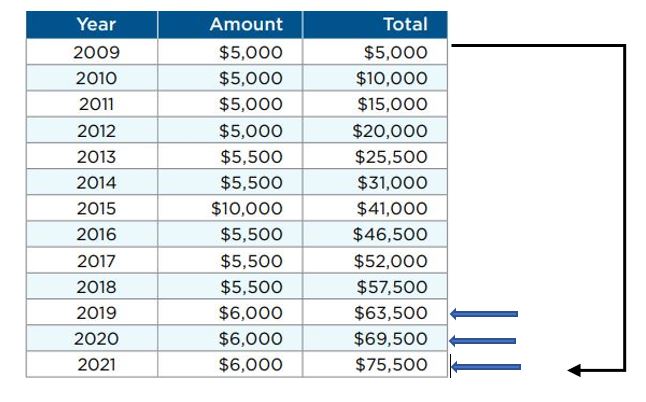

It is important to consider your age when contributing to a TFSA to know how much contributions can be made into the account. For example, someone who turned 18 years old in 2019 may only be allowed to contribute 18000$ (6000$ in 2019, 6000$ in 2020 and 6000$ in 2021) versus someone who was 18 years old in 2009 and never contributed to a TFSA, in 2021, that person would be entitled to the full 75500$ contribution space.

Contribution room automatically accumulates each year, with any unused contribution room carried forward indefinitely for use in subsequent years.

There is no tax deduction on contributions. However, an over-contribution may result in a tax penalty.

Withdrawals

- Withdrawals are tax free and allowed at any time and for any purpose.

- The total amount of withdrawals can be re-contributed into your TFSA starting the following year without impacting your contribution room. However, re-contributing in the same calendar year will result in a tax penalty if you do not have available contribution room, as it is considered an over-contribution.

Who may benefit from a TFSA?

- Investors new to the workforce; they do not have to wait and “earn” any contribution room, as they would with RRSPs. This means that individuals over the age of 18 just starting a career may use the TFSA while they build RRSP contribution room to use in later years when they are in a higher tax bracket.

- People saving for education. Since 18-year-olds are no longer eligible for RESP grants, the TFSA can be a great way to save for post-secondary education. Money can be withdrawn from the account for any reason, even if post-secondary education is not pursued (unlike with RESPs).

- Future homebuyers. Rather than contributing to an RRSP and then borrowing those same funds through the Home Buyers’ Plan, investors can save for their home by contributing to a TFSA. When the funds are taken out of the TFSA to pay for the home, there are no taxes to be paid on any growth. Also, unlike the Home Buyers’ Plan, money does not have to stay in the account for 90 days before it is eligible for withdrawal, and the funds do not have to be paid back.

- Seniors and those concerned about clawbacks. Seniors can save and still collect Old Age Security when they use a TFSA. Since investment earnings and withdrawals are not reported on one’s tax return this eliminates the possibility of clawing back benefits such as Old Age Security (OAS). That’s because income and withdrawal from a TFSA will not affect their eligibility for these benefits and credits.

- Many others

The bottom line on TFSAs: Regardless of age or investment time horizon, a TFSA should be considered as part of an overall investment strategy..

The comments contained herein are a general discussion of certain issues intended as general information only and should not be relied upon as tax or legal advice. Please obtain independent professional advice, in the context of your particular circumstances. This video was designed and produced by Flavio and Violetta Vani, an Investment Funds Advisor with Investia Financial Services Inc., and does not necessarily reflect the opinion of Investia Financial Services Inc. The information contained in this article comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any securities. Mutual Funds are offered through Investia Financial Services Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated

TFSA VS RRSP: CLICK HERE